Here's the Chart You Need to Understand Who Pays All the Taxes

Sorry, Rick Scott: we all have skin in the game.

Dear readers,

I’m going to try to do more charts, and today I have one that’s aimed at a longstanding pet peeve of mine about the the way people talk about taxes. People will point at the burden of one specific tax — like Sen. Rick Scott complaining about the large fraction of Americans who don’t pay federal personal income tax — and use that observation to make a claim about how fair the whole tax system is.

Federal personal income tax only makes up about 30% of all the taxes collected by federal, state and local governments in the US. So, if you want to assess whether the overall system tax system is fair, you have to place that tax in context with all the other taxes that provide the remaining 70% of the tax revenue.

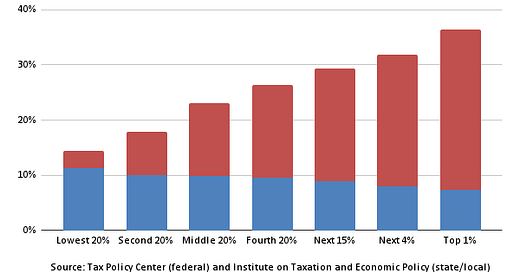

And that’s what the chart below does. I first made a chart like this for Business Insider back in 2013, but this one is updated with the most recent estimates available (2018), showing approximately how the burden of all federal, state, and local taxes is distributed across income groups.1

As you can see in the chart, people in the bottom income quintile (that is, with household incomes less than $26,000) pay about 15% of their income in taxes, mostly to state and local governments. The largest chunk of that tax burden comes from sales taxes. People in the top 1% pay closer to 36% of their incomes in tax, with by far the largest component being federal personal income tax.

It’s important to note this chart includes taxes that people pay indirectly. People who rent their homes still bear the burden of property tax, which becomes a component of the cost of rent. Sales taxes charged to businesses get passed through into final prices of consumer goods and services. Employer-paid payroll taxes are ultimately borne by workers. And corporate income taxes are mostly borne by shareholders and other owners of capital — that’s part of why the top 1% tax rate is as high as it is, and why Warren Buffett’s protest that his secretary pays a higher tax rate than he does is likely incorrect, if you allocate the burden of indirect taxes to Buffett correctly.

When you add all those tax burdens together, you get a picture of the tax system that doesn’t align with either conservative or liberal narratives. Despite what liberals may tell you, our tax code is progressive.2 And despite what conservatives like Rick Scott say, almost everyone has “skin in the game,” with even people in the lowest income quintile paying about 1 out of every 7 dollars of their incomes in taxes.

Of course, the question of what’s “fair” is subjective, and the presence of an upward slope on this bar chart doesn’t prove that our tax system is fair. Maybe the slope should be steeper. Certainly, there are inequities along dimensions that don’t show up clearly in the chart — a particularly galling one is the provision of the 2017 tax law that taxes pass-through business income at a lower rate than wage income.

But the chart is a rebuttal to claims that how progressively one specific tax is distributed tells you something about whether the whole tax code is progressive enough.

Finally, I’d note there are good reasons why some taxes are more progressive than others. Liberals tend to lament the regressivity of state and local tax systems — and it’s true especially that sales taxes eat up a larger share of income for poorer people than wealthier people. (Property tax is also somewhat regressive, but not as regressive as the folk wisdom has it.) But these taxes have real advantages: property tax is a highly stable revenue source, because people can’t move their real property in response to economic or tax policy changes. Sales tax is more stable than income tax. Diversifying across several different tax bases helps protect states and localities from wild budget swings that, unlike the federal government, they are not allowed3 to simply borrow their way through. And the federal government is better positioned than states to administer a highly progressive income tax — wealthy retirees can’t easily flee the federal income tax in the same way they can move from New York to Florida.

So there are good reasons you’d have exactly the system we do — state and local taxes with a flat or even somewhat regressive burden, offset by a larger federal tax system with a high level of progressivity. So long as the overall system meets objectives for fairness, it doesn’t matter if one particular tax is more or less progressive than the overall target.

Which, again, is not to say: don’t complain about the tax system. But when you complain, do so after looking at this chart, with an understanding of how the overall tax burden is shared.

Very seriously,

Josh

Unfortunately, TPC and ITEP use somewhat different definitions of income, so the correspondence between the bars on this chart is not perfect. I would not cite these tax burden estimates down to the tenth of the percentage point. But the overall shape of the chart is correct — tax rates start well above zero at the bottom of the income scale, and they go up as income goes up.

To be clear, calling a tax “progressive” or “regressive” is not a normative judgment. “Progressive” simply means the percentage of income paid in tax goes up as income goes up; “regressive” means it goes down as income goes up.

Every state except Vermont is subject to a self-imposed legal requirement to balance its budget. In practice, the level of adherence to these requirements is varied. Some states (like Illinois and New Jersey) have frequently borrowed from their public employee pension funds to finance deficit spending. But to a first approximation, the claim is correct: states are constrained in how much they can borrow to finance operational spending (even if the constraint is not always followed as stringently as it should be) and therefore recessions create budget deficits that must be closed in significant part through tax increases and spending cuts.

A sober-minded and fair analysis.

This progressivity is partially why I am skeptical of the "soak the rich" mentality so prevalent on the left. Especially when compared to other OECD nations, the U.S. has one of the most progressive tax systems in the developed world.

You can have a single-payer health system, and maybe free college and some other things, but the belief that it will all be financed by the 25,000 richest households in America just doesn't hold water.

Is there a chart somewhere that does this for "share of total tax dollars paid"? I've seen charts to that effect from libertarian/conservative leaning sources (eg https://taxfoundation.org/publications/latest-federal-income-tax-data/ in the section "High-Income Taxpayers Paid the Majority of Federal Income Taxes") on federal income taxes and I'd love to see something similar that incorporates other tax data as well.