So, Why Not the Coin?

The strategy involves torturing the central bank into doing things no central bank should have to do.

Dear readers,

I wrote Wednesday about the potential usefulness of premium bonds for defusing a debt limit crisis. A question several people have sent to me by email is: Why not the platinum coin? And it’s a fair question, given how much I wrote in 2013 advocating the coin as a strategy for getting around the debt limit crisis we faced then.

Joey Politano, who writes the very good

Substack , is also skeptical about premium bonds:

I touched on this briefly in the last issue, but I think the coin has several pitfalls that don’t apply to premium bonds, some of which are of more acute concern today than they would have been in 2013.

While Treasury can execute a premium bond strategy all on its own, the coin strategy requires cooperation from the Federal Reserve that would be difficult to obtain

In general, the Treasury is prohibited from simply printing money to pay the government’s bills. Due to a legislative drafting error, there is a loophole in this prohibition: Treasury may mint commemorative platinum coins in any denomination. Therefore, the idea behind the coin strategy is that Treasury could strike a platinum coin with a very large value, such as $1 trillion, deposit it with the Federal Reserve, and then start paying the federal government's bills with the cash it has printed.

A little farther down, I’ll get into how this could impact inflation — there are some valid worries and some invalid ones — but first I want to talk about the Fed’s willingness to play ball.

The coin strategy depends on the Fed agreeing to accept the coin for deposit. Back in 2013, when the Obama administration was seeking to squash talk about the coin — they thought it undermined their ultimately successful efforts to get Congress to agree to raise the debt limit — a Treasury spokesperson told the Washington Post that the Fed had told them it would be unwilling to accept the coin. The Fed, they said, did not believe the coin’s issuance would be legal.

The New York Times had a story the other day that discussed the Fed’s extreme reluctance to involve itself in circumventing the debt limit, looking at minutes of internal discussions at the Fed during the 2011 and 2013 debt ceiling crises about possible roles for the bank:

If the government failed to make regular payments on some bonds, those securities could plummet in value and become difficult to trade. The Fed has a few ways of siphoning defaulted Treasury bonds out of financial markets, which could help to prevent them from causing broader problems. For one, it could accept the bonds in operations that take government debt as collateral, based on the 2011 transcripts.

And the Fed’s staff suggested in 2013 that the central bank could purchase defaulted Treasury bonds outright — or swap them for healthier ones — in a bid to keep markets functioning.

But such intervention would plunge the carefully apolitical central bank into the center of the partisan fray. If the Fed succeeded at mitigating the financial fallout, it might make it easier for the debt ceiling fight to continue. Plus, the Fed would be imperiling its independence to pursue its own policy goals — most notably stable prices — if it abruptly reversed its current policy of reducing its bond holdings in order to save the broader government.

“Such actions would insert the Federal Reserve into a very strained political situation and could raise questions about its independence from Treasury debt management issues,” William B. English, a Fed staff member, said during the 2013 call.

Jerome H. Powell, who is now the Fed’s chair, called the possibility of purposely buying defaulted Treasury debt “loathsome” during that meeting.

Nathan Tankus argues in the Financial Times that minting the coin is not only legal, but that the Fed has a legal obligation to accept the coin. He acknowledges that even if he is right about the legal matter, Treasury suing the Fed to force acceptance is unlikely to work on the necessary timeline.1 He concludes his argument essentially by arguing that Treasury could jam the Fed into cooperating with the coin gambit — that, forced to choose between accepting the coin and allowing a default on US government bonds, the Fed would have little option but to take the coin, even if it doesn’t want to.

Tankus may be right about that.2 Still, that you might eventually succeed at dragging the Fed, kicking and screaming, into participating in a strategy is not a good argument for relying on it.

A key objective in sidestepping a debt limit crisis is to calm financial markets. We want investors to worry as little as possible about the prospect of a payment default. Since a strategy of jamming the Fed necessarily involves waiting until the 11th hour before it becomes clear that the strategy is going to work, it will not calm the financial markets — we’ll have to be in a state of near-panic for the Fed to actually be jammed into acting.

Plus, the depth of the Fed’s required cooperation would go well beyond accepting the coin for deposit. Managing the use of the coin so it doesn’t cause inflation to spike would require the Fed and Treasury to work hand-in-glove in a way that would undermine the Fed’s independence and its ability to pursue its other mandates, and that might be especially difficult to achieve in a circumstance when Fed officials are sore over being dragged unwillingly into the scheme.

The platinum coin strategy would create challenges related to inflation and interest rates

You might think it would be inflationary if the Treasury simply created a trillion dollars of new currency out of thin air and used it to pay the government’s bills. But the coin would not go into circulation — Treasury would deposit it with the Fed. Then, the idea is that, as Treasury used its new cash stockpile to pay the government’s bills, the Fed would sell Treasury bonds into the open market, as a substitute for the bonds Treasury itself isn’t allowed to sell right now. The Fed could do this because it has trillions of dollars of Treasuries on its balance sheet, many of which it bought up as part of its strategy to mitigate the economic crisis related to COVID.

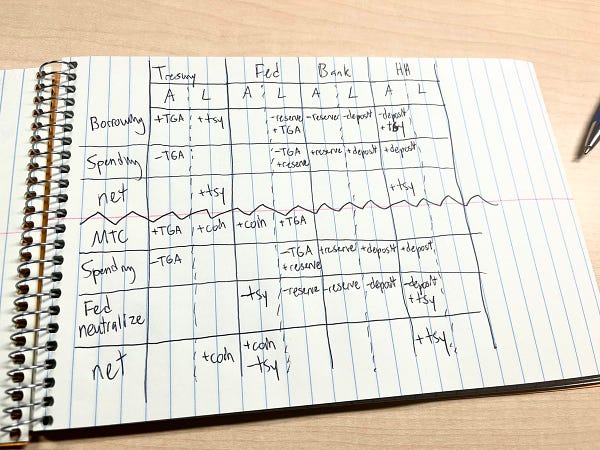

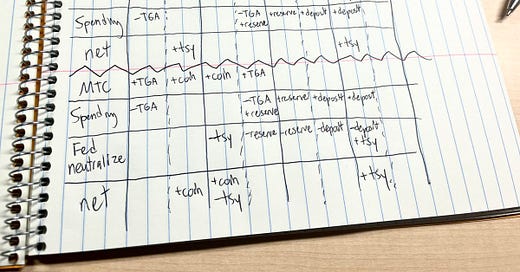

In theory, this should all wash, with no effect on the money supply compared to a normal scenario where Treasury borrows and spends:

But there are still problems:

These actions would politicize the Fed and undermine its independence. In order to stabilize expectations about inflation, the Fed would have to communicate very clearly about its intentions to coordinate its fiscal actions with Treasury — that is, it would have to tell the world that it’s going to act as Treasury’s surrogate in selling bonds when Treasury can’t. The Fed, which is a creature of Congress and which is supposed to have independence in order to conduct monetary policy, would be announcing its intention to act as a core participant in the Biden administration’s effort to end-run around the House of Representatives in its conduct of fiscal policy. This would undermine support for the bank’s continued independence and could motivate Republicans in Congress to seek legal changes that would restrict the Fed’s ability to pursue appropriate monetary policy in the future.

These actions would interfere with the Fed’s normal monetary operations. The Fed has pre-existing reasons why it has trillions of dollars of bonds on its balance sheet, and reasons why it increases or decreases the size of those holdings. For example, the Fed is currently already reducing its holdings of bonds as part of its strategy to fight inflation. If economic conditions change (fairly likely, in the event of a near-default situation) that might change the Fed’s desired balance sheet strategy. But it could be difficult to explain why the Fed is making a given adjustment in its purchases or sales of bonds: Is this to offset Treasury’s fiscal activity, or is it to stimulate or cool the economy? That lack of clarity would make it more difficult for the Fed to communicate clearly about its plans to control inflation, which could itself cause inflation expectations to rise.

Even if the Fed does everything it’s “supposed” to do, minting the coin could still increase inflation expectations and undermine economic stability. The theory of the coin is that Treasury would print money and the Fed would sell bonds for a while; then, eventually there would be an agreement between Congress and the White House, the debt limit would be raised, Treasury would issue new bonds that the Fed would buy from the Treasury using the coin; Treasury would melt the coin down or put it in a museum, and in the end all the balance sheet entries would look the same as if we hadn’t done any of this nonsense. But what if people do not believe there will be an agreement allowing this endgame? After all, the whole reason we’re in this mess is the lack of consensus about what such an agreement should entail. If market participants fear that this ends not with a deal to issue debt, but with the government simply being left printing money to pay bills, then that would cause inflation expectations to rise now.3 The Fed would have to respond with further policies to tighten financial conditions — e.g. more interest rate hikes — which would have negative effects on the real economy. Additionally, the Fed could be put in an impossible condition by needing to fight two problems requiring opposite actions — spiking inflation, which requires tightening; and a financial crisis, which requires loosening.

These are all complicated ways of saying that the Fed’s ability to manage inflation could be severely impaired by taking on the fiscal responsibilities required by the coin approach. In 2013, this was somewhat less of a worry because inflation was, if anything, too low. Right now, the Fed’s efforts to tame inflation without putting the economy into a recession are the most important part of the federal government’s economic policy, and undermining its resources there — both political resources and operational ones — would be a big mistake.

Finally, it’s important to note these challenges would increase the government’s cost to borrow through several channels: interest costs would rise due to greater uncertainty over future inflation; interest costs would rise if the Fed had to raise rates in order to address inflation fears; and interest costs would rise to the extent the process fails to allay concerns about potential future debt defaults.

The coin is the wrong style of gimmick

This is only my third-most-important objection to the coin and I don’t want to overstate its importance. I openly admit that premium bonds are a gimmick, too. I do think, for the purposes of ultimately trying to reach a legislative agreement on spending and debt that allows us to return to normal operations, a gimmick that is boring and inscrutable is better than one that is flashy and attention-grabbing.

But again, this isn’t my main concern, and if it weren’t for the issues related to inflation and Fed independence, I wouldn’t worry about it too much.

Of course, the premium bond approach is not the ideal way to manage a government’s finances, either. I talked about some of the concerns about premium bonds and how you might test them in my piece earlier this week. But that’s also why I frame the premium bonds as another component of “extraordinary measures” — the existing set of “extraordinary measures” is important for avoiding default crises, but nobody sees it as a substitute for eventually raising the debt limit and financing the government in the normal manner.

Ultimately, it’s still necessary to work toward legislative deals on government spending levels and raising the debt limit. If we need additional tools to give us more time to get to that deal (and we might this year) we should want to pick the tools that do the least along the way to damage institutions and increase the government’s borrowing costs. And the coin simply entails too much disruption to the normal relationship among the Federal Reserve, the Treasury, and Congress.

That’s all the highly technical fiscal and monetary policy content for this week! I’ll be back tomorrow with answers to your questions in the Mayonnaise Clinic (submit your questions and comments below, or send them to mayo@joshbarro.com).

Very seriously,

Josh

Tankus’ ideological ally, Willamette University law professor Rohan Grey, is more intemperate, telling Washington Post reporter Jeff Stein that you could “send troops to the Fed” to force acceptance — even if the Supreme Court has already ruled against the plan. Needless to say, any strategy that requires armed intervention against the central bank in contravention of a court ruling is unlikely to actually convey the message of stability and normalcy to financial markets that we’re going for here.

To Tankus’ point about the possibility that the Fed might be pressured to do something it really doesn’t want to: While Jerome Powell (then a member of the Federal Reserve Board) called the prospect of buying up defaulted bonds “loathsome” in the 2013 minutes, he didn’t rule out the possibility of doing it if push came to shove. I should note that I also personally argued back in 2013 that jamming the Fed would be possible.

In theory, if the crisis went on long enough without a debt limit agreement, the Fed would run out of Treasury bonds to sell.

The coin doesn't pass the laugh test. If you do it, regular people will never take you seriously again. Partly because Biden is about as close to a regular person as we've had be president in the last century, I'm pretty doubtful it will happen.

I think the real problem here is that not everyone likes mint. If we could Oreo a platinum coin, I think we would have greater public buy-in.