There's No Disconnect In Public Opinion on the Economy

People say their personal economic situation is good because balance sheets are strong. Income statements are another matter.

Dear readers,

It has mostly settled in for Democrats and for economics journalists that inflation is a real, large problem that is understandably upsetting to the public. The denial that prevailed last fall has abated, mostly. But occasionally it sticks its head back up, as it has a bit this week, on the back of a report from the Federal Reserve showing that Americans were very upbeat about their own household finances as of October and November 2021.

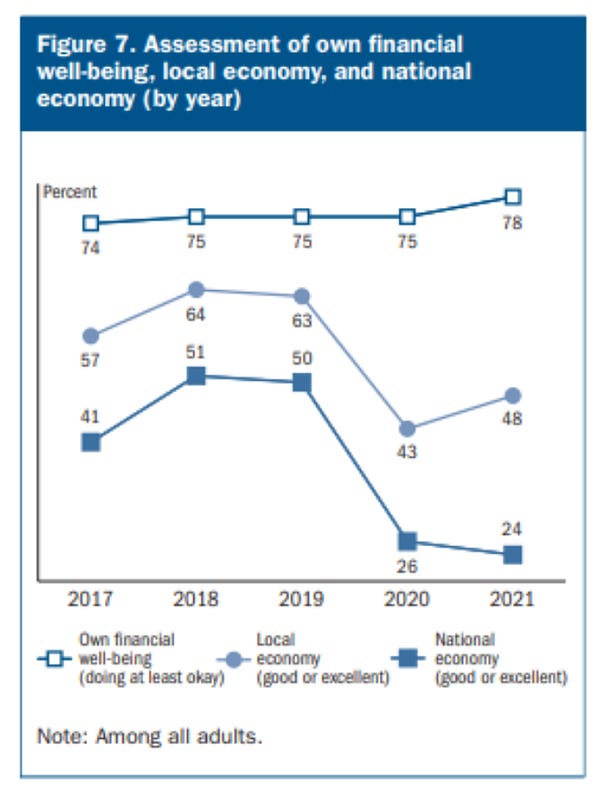

Indeed, the readouts from the Fed are good. The bank’s annual Survey of Household Economics and Decisionmaking found that 78% of adults said they were living comfortably or doing “okay” financially last fall, the highest level since the Fed started conducting the survey in 2013. Meanwhile, the survey found serious deterioration in assessments of both local economies and the national economy compared to pre-pandemic (though not compared to 2021).

The challenge with understanding these data is that it’s a very odd time in American household financial well-being.

Balance sheets are great. The US implemented huge fiscal stimulus in 2020 and 2021 to mitigate pandemic economy effects, which swelled bank accounts and also made it easier for economic activity (and employment) to return to normal more quickly as the pandemic abated. The result was that Americans paid off debt and socked cash in their bank accounts.

This is what JP Morgan CEO Jamie Dimon and Bank of America CEO Brian Moynihan have been on about this week: They’re not worried about consumer sentiment in the face of inflation, spending seems to be robust, and by the way, account balances are still really high. People have money and are spending it, despite the soft announcements from retailers that have been pushing their stocks down.

Now, part of what’s happening with the banks vs. retailers divergence that Conor mentions is the banks really are doing better than the retailers lately. The pandemic drove a big shift of spending away from services toward goods, but now we’re seeing the long-awaited unwind of the goods-to-services shift, which is fine for the banks and great for service companies like airlines, but rough for retailers.

But how does this all feel for consumers? Yeah, they’ve got plenty of money in the bank. They’re less afraid than usual of losing their jobs. Those factors are things to feel good about. They are also why we have inflation — people have more money than usual and they aren’t afraid to spend it. And so those consumers with the flush bank balances and the confidence to spend keep going to the store (or on those airline websites) and they see that prices are way up — rising a lot faster than their incomes. They buy, because why not, but are they happy about the whole situation?

“Your real income is falling but that’s okay because you can dig into your wealth” is not an appealing message — but it describes what consumers are actually doing, having shifted to saving less than normal this year after posting significantly above-normal saving rates in 2020 and 2021. In that context, it makes perfect sense to me that consumers would say their personal financial situations are comfortable and they are also dissatisfied with the economy.

One big question then is how members of the public will feel about the economy as the inflation cools. When the Fed raises interest rates to cool inflation, the direct effects are not fun — stock prices fall, hiring slows, consumer credit becomes more expensive to obtain. These effects should all make people feel less good about their personal finances: brokerage account balances become smaller, new or variable-rate debt becomes more burdensome, and job prospects feel a little less secure. You’d expect all those things to make people more dour about their own economic outlooks in next year’s Fed survey. But if prices are also rising a lot more slowly, they might be happier about the economy anyway.

The problem there is the big if. The most unfortunate part of this economic story is that the war in Ukraine — which began months after the Fed survey was conducted — is a real negative economic shock that threatens to prolong inflation even in a cooler economic environment. That raises a couple of rough possibilities. One is that the Fed’s actions won’t do enough to bring inflation close to normal, even if they hit domestic spending pretty hard, because of this foreign matter pushing up food and fuel prices. Another is that the Fed will succeed in taming inflation, but together with the Ukraine mess, that will bring us into recession. In either of those scenarios, we won’t even get to test whether the public forgives a modest economic cooling if it comes with significant moderation of prices — there will be too much free-floating economic pain to know.

Gabriel Debenedetti has a good dive for New York magazine on who could replace Joe Biden as the Democratic nominee if he doesn’t seek re-election in 2024.

First, though, I have to say I think people still greatly overrate the likelihood this will happen. By and large, the people saying Biden is too old and too weak to be the nominee next time were also saying that last time;1 they were wrong then, and Biden’s road to re-nomination will be a lot easier that his road to nomination. But Debenedetti’s piece isn’t advancing an argument that Biden won’t run — it’s advancing an argument that people throughout the Democratic Party are preparing for the possibility that he won’t run, in a way we did not see in the first terms of other recent presidents, and that’s clearly true. Lots of people are setting up shadow campaigns; they think Biden may not run.

One of the reasons I still strongly expect Biden will run is what Debenedetti implicitly lays out in the piece: It’s hard to imagine a situation where the Democratic Party is better off if he steps aside. Kamala Harris is less popular than Biden, with zero political acumen. She wouldn’t get a clear shot at the nomination — the same Democratic insiders who think Biden is weak think the same about her. You’d have a wild scrum for the nomination while Biden sits in the White House as a lame duck, and who knows who would get nominated and how unappealing they might be. It’s hard enough to convince someone to step aside for the good of the party; Biden wouldn’t even have to delude himself into thinking that Democrats are better off with him than without him, however weakened and unpopular he might be.

All that said, I think there’s one thing missing from Debenedetti’s piece. In a world where Democrats are shopping for a new nominee in 2024, things have likely gone horribly wrong for Democrats in 2022. The drape-measuring decadence of the 2020 primary campaign — hours and hours of tedious debates about which flavor of Medicare For All a Democratic president would whisk through Congress — would not be on order. You’d have a fight over who can reverse the carnage and actually win back who was lost.

And in that context, I think the most promising names would tend to be candidates who manage to post solid wins on contested ground in the face of a national shellacking this November. That won’t be Silicon Valley Rep. Ro Khanna; it won’t be New Jersey Gov. Phil Murphy, who just eked out re-election in a blue state last year. It could be a governor like Gretchen Whitmer or Jared Polis; or, though he isn’t on the ballot this year, Roy Cooper.2 But I think one of the most interesting possible names in that scenario is John Fetterman — if he posts a solid win in Pennsylvania, reclaiming a Republican-held Rust Belt Senate seat on a night that’s grim for the party elsewhere, it will give him an instant national narrative about how he could rebuild a winning coalition for the party.3

Again, I don’t expect an open nominating contest in 2024; I expect Biden to seek re-election. But as Debenedetti notes, Biden is closely familiar with the vagaries of fate, and he himself is often careful to point out that nobody can predict the future for sure. And that’s where I’d expect the conversation to start, if we have it.

That’s all for today. Tomorrow I’ll answer your questions in the Mayonnaise Clinic, and it’s not too late to contribute. Send your questions to mayo@joshbarro.com.

Very seriously,

Josh

Remember, New York, my former employer, ran a cover asking “How Is This Guy Still Winning?” in October 2019.

Debenedetti’s piece focuses heavily on chatter about North Carolina Gov. Cooper, who was first elected in 2016. Cooper is a client of my husband’s, which is a reason I don’t tend to write about him much, but he has twice won his red-leaning state on the same day as Donald Trump, which would be his credibility on this point.

Fetterman is likely to be helped along by the Pennsylvania GOP, which is about to go through a recount fight on the way to nominating a deeply flawed Senate candidate, distrusted by many conservatives, who isn’t even from the part of New Jersey near Pennsylvania; and which has nominated a total lunatic for governor.

It feels ghoulish to speculate about this, but people are gaming out these campaigns because of Biden's age and health. He's 79! Fetterman was just hospitalized for a stroke at 52.

Biden could die in office, or have to resign for health reasons, or he could chose not to run again for health reasons, or he could decide not to run again because he is politically toast and attribute it to age or health, or he could run again even though he clearly wasn't healthy enough to serve & justifiably be primaried (look at Feinstein and RBG: old, powerful people often can't read the writing on the wall about their own health), or a Democrat could run against him for some other reason in which case no matter what Biden's age and health would be the #1 implicit campaign issue, even if Biden were still up to snuff & blew the challenger out of the water.

Kamala Harris remains the overwhelmingly most likely nominee if it isn't Biden, alas. Let's hope he keeps taking his Metamucil.

I work for a big company in an engineering role and we just got an announcement about a hiring freeze “to see what the economy does in the next quarter.” This is coming off of having a dozen open positions in very close proximity to me, and far more under my VP. Furthermore, I was just reading a post on Hacker News about someone who had a job offer rescinded due to worsening economic outlook... Job prospects aren’t going to be so rosy by the end of the year, at least in the high paying pajama class world.