This Week in the Mayonnaise Clinic: Biden Should Cut Gasoline Taxes

Plus: Does Josh care about music?

Dear readers:

Happy Wednesday! It’s time for another edition of the Mayonnaise Clinic. But first I want to note a milestone: Very Serious has crossed 2,000 paying subscribers. Sara and I are so grateful to all of you who are supporting this independent media project and making this podcast and newsletter possible. We really appreciate it.

All right, on to the dispensing of advice.

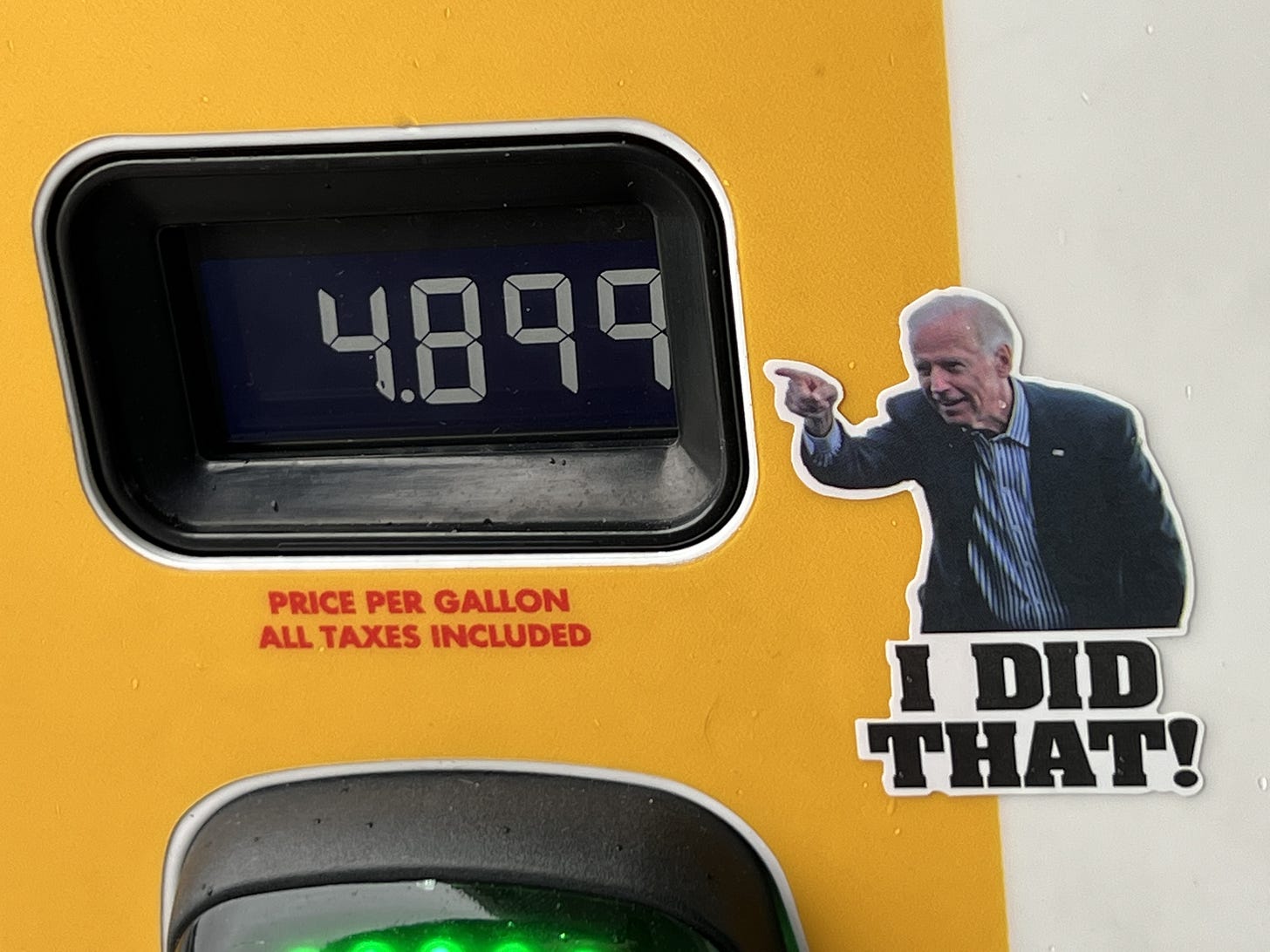

While it didn’t technically come in a letter to me, I want to weigh in on a controversy that’s going around the internet: whether President Biden should seek a gasoline tax holiday, and whether it would even do anything to lower gasoline prices at the pump.

My broad answer to both questions is yes. A gasoline tax suspension is a very “problem solver just looking to help people out” policy, and that’s a sweet spot for Biden, even if it’s kind of a gimmick.

The political argument for a gas tax holiday is simple: It’s popular. A new Politico/Morning Consult poll finds overwhelming support for suspending the gas tax for the rest of the year: 68% of respondents say they’d favor a suspension, while only 16% are opposed. And in addition to being popular, this policy is highly salient to voters: People won’t just like the gas tax holiday, they’ll also be highly likely to notice that it happened.

A gas tax holiday is something Biden could put before Congress and produce one of two politically desirable outcomes: Republicans support the tax holiday and Biden has another bipartisan policy achievement; or Republicans oppose the tax holiday, and he gets to say they’re fighting to keep gas prices high. Biden might also draw environmentalist objections from his left flank, which would allow him to appear more moderate by prioritizing consumer preferences over their agenda.

That said, economists generally hate gas tax holidays, which they see as a policy that creates no economic benefits. They deprive government of a main revenue stream that’s supposed to be for transportation, and they don’t address the long-run supply-demand imbalance in oil markets. Also, some of the benefits end up in the pockets of oil companies, not consumers.

The fight has gotten a little technical. Paul Krugman thinks economists hate gas tax holidays a little too much. In particular, he thinks they wrongly assume retailers will just raise pre-tax gasoline prices to absorb the entire benefit of the tax cut:

I’ve been astonished to encounter Democratic-leaning economists and economics writers asserting that a gas-tax cut wouldn’t help consumers and that it would simply increase oil company profits. What? The price of crude oil is set on world markets and can’t be much influenced by U.S. policy. But there’s no world market for retail gasoline; Europeans can’t fill their tanks at American gas stations. There are, in fact, large international differences in gasoline prices, precisely because tax rates are so different.

But Jason Furman (my podcast guest from last week) says he hasn’t seen anyone say temporary gas tax cuts “simply” accrue to oil companies, with one exception: Paul Krugman.

Keep reading with a 7-day free trial

Subscribe to Very Serious to keep reading this post and get 7 days of free access to the full post archives.