When Will Interest Rates Make Voters Care About Deficits Again?

In the 1990s, voters understood that the federal budget deficit was costing them, personally. That economic situation has returned, but awareness hasn't.

Dear readers,

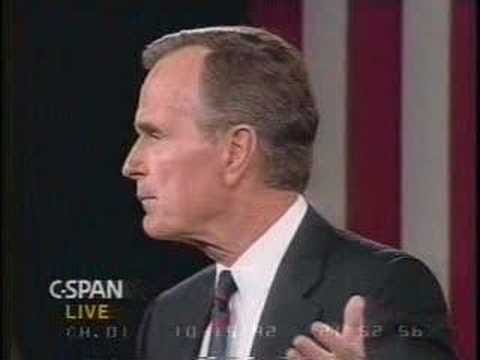

The 1992 presidential campaign was a three-way contest, but one key economic issue was a point of consensus among the three candidates: the excessively high federal budget deficit was making life more expensive for ordinary Americans, and it needed to be reduced. Deficit reduction was the crux of Ross Perot’s campaign platform — an unthinkable focus for a “populist” insurgent campaign today — and George Bush and Bill Clinton both put their money where their mouths were, signing major deficit reduction laws (in 1990 and 1993, respectively) at significant political cost due to provisions in the laws that were unpopular in the short term.

Today, neither political party makes deficit reduction a priority. Democrats have a long list of taxes on corporations and the wealthy they’d like to raise if they regain full control in Washington, but they have an even longer list of ways they’d like to spend that money on social programs and tax cuts for middle-income families. Democrats did pass a law aiming to reduce the deficit in 2022, but the deficit-reduction focus was specifically designed to obtain Sen. Joe Manchin’s necessary support for a law whose new environmental spending programs were the core policy objective for most Democrats. (That law probably won’t even reduce the deficit, because the green tax credits it authorized are proving far more expensive than expected, and next year, Manchin won’t be in Congress to insist on deficit reduction in future laws.) Republicans, meanwhile, have routinely exploded the deficit when they control the government. Donald Trump is promising more tax cuts if he’s elected again. Maybe Republicans will try to cut the deficit through sharp cuts to health care programs for the poor, but then again, maybe they won’t; Republican politicians these days are reluctant to talk about it either way.

When people asked me why our politics have changed in this way, I used to have a simple answer: interest rates. Back in the 1980s and early 1990s, high government budget deficits were making the debt markets too crowded. When the government was borrowing a ton of money, it was competing with private borrowers who were also eager to borrow; in doing so, it bid up the price of borrowing, i.e., interest rates. This economic reality created a politics where politicians felt compelled to find ways to control the deficits so interest rates could ease, which would make it easier for businesses to invest and consumers to buy homes and cars.

But eventually, the economic situation changed. We went through a two-decade period of persistent economic slack. Private demand for capital was lackluster, and so when the government borrowed and spent more, it didn’t cause significant pain for everyone else through the interest rate channel — in fact, government borrowing and spending could boost the economy by stimulating employment and bringing otherwise-idle economic resources into use. So I’ve long thought deficit reduction fell out of fashion in our politics for largely sensible reasons — cutting deficits was a lot less likely to produce tangible benefits for the public in the 2000s or the 2010s than it was in the 1980s or early 1990s.

But now the economic conditions of the early 1990s have reasserted themselves. Since late 2021, crowd-out has roared back: money is tight, and when the government competes with private borrowers, the result is the elevated interest rates and inflation we’re experiencing right now. But not only have the deficit politics of the early 1990s not reasserted themselves, politicians and voters haven’t even regained the vocabulary they had 30 years ago about why the deficit mattered.

‘How has the national debt personally affected each of your lives?’

This was the defining question of the 1992 presidential debates, posed to all three candidates by an ordinary member of the public at the second, town hall-style debate of that campaign.

This debate question is memorable mostly because of the answers it elicited: Bush struggled with the “personally” aspect of the question and offered the accurate but not-especially-warm observation that “obviously, it has a lot to do with interest rates”; Clinton asked the voter how she had been affected and then discussed how he experienced people’s economic struggles close up as a small-state governor — “In my state, when people lose their jobs there’s a good chance I’ll know them by their names. When a factory closes, I know the people who ran it.” — as Bush smirked from behind him.

But I want to focus on an aspect of the question: the questioner did not ask how unemployment or interest rates or the then-recent recession had personally affected the candidates; she asked how they were affected by the debt, a question that takes as given the idea that when the government borrows money, that has an effect on the finances of ordinary people. I’m not suggesting that ordinary voters 30 years ago had a granular understanding of the interaction between monetary and fiscal policy. But I do think a lot of voters shared the intuition that, when the government borrows a lot of money, that makes it more expensive for anyone else to buy things, especially if they need to borrow money to do it.1 And this intuition was considered sufficiently widely-held that it even showed up in 30-second campaign ads. For example, when seeking re-election in 1996, Clinton attacked Bob Dole for his $550 billion tax cut plan, arguing that it “balloons the deficit, raises interest rates, hurts the economy.”

The key question I have is: now that this intuition is correct again, how can we make it widely shared again?

Motivated reasoning keeps both parties from prioritizing deficit reduction

The trouble for Democrats is that admitting the deficit matters again requires admitting that their agenda is impossible. The party has increasingly committed to the idea that the US should have a European-style welfare state with far more generous health, child-care and higher education benefits — Biden and Harris claim, for example, that in a second term they will cap child-care costs at $10 a day for most American families — while also committing to the idea that taxes should never be raised on anyone who makes less than $400,000 a year. The truth about those European welfare states is they’re financed by broad-based, double-digit value-added taxes that fall broadly on the middle class, and Democrats dare not even propose that kind of tax policy. Instead Democrats propose to raise taxes on the rich, and when they do, they want to triple-count those tax increases, taking the same dollar and saying it pays for child care and health care and a middle class tax cut. Using the dollar for deficit reduction means giving up on all three of those goals — it’s just not a fun place for the party to have to go, and Democratic politicians have spent years telling their voters they don’t have to.

To get Republican voters to care about the deficit seems like it should be easier. Republicans even have a broadly correct intuition right now: Joe Biden and the Democrats spent too much in 2021 and 2022, and all that spending fueled inflation and interest rates and made life more expensive for ordinary Americans. This is why Donald Trump might become president again, despite everything: this attack is intuitive, potent, and more or less true. The problem for Republicans is that, for fiscal policy to ease inflation and interest-rate pressures, you need to cut spending while keeping taxes the same. (As Clinton succinctly argued in that 1996 anti-Dole ad, a deficit-increasing tax cut creates the same kind of inflation and interest-rate pressures that deficit spending does.) But Republicans’ primary policy objective is tax cuts, and so they need to come up with a mental model that promotes tax cuts; therefore, they choose to believe that it is any kind of government spending, rather than government spending financed by borrowing, that fuels inflation and interest rates. This belief is incorrect, and the fact that the party holds it is why Republicans are likely to boost the deficit if they control the government next year.

I will keep doing my part by telling people that the deficit matters again, but my view on what it will take to change the broader political dynamic is pretty grim. I don’t really believe in political leadership — I think politicians say what voters want to hear, and so politicians will only talk about deficit reduction as a priority if the voters want to hear it. If presidential candidates were harping about deficit reduction in 1992, it must have been because that’s what constituted pandering back then — the voters wanted to be told the deficit would be reduced. And if voters came to care about budget deficits as an issue, it must have been because they lived through many years of high interest rates in the 1980s. The cost of the trade-off between government and private borrowing had been visited upon them for long enough that they noticed what was happening and demanded that politicians do something about it. And I don’t think we’ve been going through this pain nearly long enough for voters to have noticed, en masse, what’s causing it.

Very seriously,

Josh

I think the concept of government crowd-out is pretty intuitive when it involves goods or services rather than money itself. Here in New York City, the city government has rented out tens of thousands of hotel rooms to provide temporary shelter to unauthorized migrants. This has reduced the supply of hotel rooms available to the public, and has thus made hotels in New York more expensive. This is not terribly different from what happens when the government goes out and borrows lots of money at a time when there is high demand for capital: money becomes more expensive for anyone else who is trying to borrow it.

This sentence is so true: "The truth about those European welfare states is they’re financed by broad-based, double-digit value-added taxes that fall broadly on the middle class, and Democrats dare not even propose that kind of tax policy." I for one would pay higher taxes if it meant significantly reducing or eliminating my health insurance premiums, significantly reducing out-of-pocket costs for healthcare, and not paying $2k+ per month for daycare (and we only have one child!). I'd almost certainly come out better budget-wise. Why we can't get this message across to voters -- "yes, you'd spend more on taxes, but you'd likely come out ahead in the end!!" -- is a mystery to me. It's not a scenario of paying more taxes on top of what we already spend, it's a trade, and it's so strange to me that this is seemingly so hard to convey to people.

Actually, not really. I cited Keynes and some Keynesian economists. "Crowding out" was disproven well before MMT became a thing. For the record, there are many aspects of MMT that I disagree with. Unlimited government spending in the wrong hands can be a major political, as well as economic problem. And for the record, I do think government spending should be wound back now, as I am concerned about potential inflationary pressures.

But your description of how government crowds out private spending is factually incorrect, that's all. We can have a sensible discussion about that without resorting to name-calling.